HDFC Millennia Credit Card

HDFC Millennia Credit Card is one of the premium segment credit card of HDFC Bank. With some condition, you will take this card without any joining or annual fees. HDFC Bank offers lots of discounts and cashbacks with Millennia Credit Card.

In this Card, You will get 5% cashback on Amazon, Flipkart, Swiggy, Uber and also lot of brands. Apart from this, with this card you will get free airport lounge access, fuel surcharge waiver, Exclusive Dining Privileges and many more facilities.

We have written in HDFC Millennia Credit Card review with details benefits and specifications. Hope you will enjoy it.

Product Highlights:

As a Welcome gift get 1000 Cashpoints on payment of joining fees.

Get 5% Cashback on Online Brands like Flipkart, Amazon, Swiggy, Zomato, Uber, Bookmyshow, Myntra, Tata CLIQ and Cult Fit.

Get 8 Complimentary Domestic Lounge Access every year (2 per quarter) in HDFC Millennia Credit Card on selected airport.

With this card, get upto 20% discount via dineout on partner restaurents.

Get 1% cashback on all other transactions also on EMI Purchases (except fuel).

HDFC Millennia Credit Card Features & Benefits

Welcome Benefits & Cashback

As a Welcome offer, Get 1000 Cash Points on payment of Joining fees.

5% Cashback on Select Online Brands like Swiggy, Zomato, Flipkart, Uber, Amazon, Bookmyshow, Myntra.

1% Cashback on all other online and offline spends (except fuel) like other credit cards.

Through Dineout, Get 20% discount on partner restaurents.

On spends of Rs 1,00,000 ond above in a calender quarter, Get gift vouchers worth Rs 1000

Joining & Renewal Fees

Joining Fees: Rs 1000/- & taxes

Renewal Fees: Rs 1000/- & taxes

Renewal fees waived off by Bank, if customer spend minimum 1 lac rupees in previous 12 months.

Through some condition, customer can also get this card is lifetime free.

Fuel Surcharge Waiver

Get 1% fuel surcharge waiver through HDFC Millennia Credit card at all fuel stations in india. (Transaction value is in betwen Rs 400 to Rs 5000)

In per billing cycle, you can get maximum fuel surcharge waiver 250 rupees.

Airport Lounge Access

Get 8 Domestic airport lounge access per year (Maximum 2 Lounge access per quarter)

Reward Points

In Millennia Card, You will earn cashback in form of cashpoints, Which you have to redeem.

If You redeem cashpoints against statement balance then, 1 Cashpoint = 1 Rupees.

If You redeem cashpoints at HDFC Smartbuy portal then 1 Cashpoint = 0.30 Rupees.

Minimum 500 cashpoints is mandatory to redeem cashpoints against statement balance.

Movies & Restaurents

Get 5% cashback on movie tickets through Bookmyshow, if you access bookmyshow via HDFC Payzapp.

Get 2.5% cashback on movie tickets, if you book tickets through online.

Get 2.5% cashback on entertainment app subscriptions like Netflix, Amazon Prime, Hotstar.

Get 2.5% cashback on online food delivery apps.

Get 20% discount on Dineout partner restaurent through Dineout app.

HDFC Millennia Credit Card Fees & Charges

Cash Advance Fee: 2.5% of cash amount withdrawn or 500 Rupees Whichever is more higher.

Overlimit Charges: 2.5% of overlimit amount or 550 Rupees Whichever is more higher.

Balance Transfer Charges: 1% amount of Balance Transfer amount or 250 Rupees Whichever is higher.

Interest Rate: If you not pay your due amount of credit card before due date, then you have to pay 3.6% monthly interest on due amount.

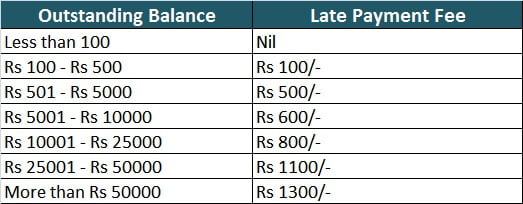

Late Payment Charges: With interest rate, you have also to pay late fine charges if you not pay your due amount on before due date. Late fine vary upon credit card outstanding balance, mentioned details below.

HDFC Millennia Credit Card Eligibility

There are 3 methods to get HDFC Millennia Credit card easily if you have not any pre-approved offer from HDFC Bank. Mention below these methods:

| Salaried | Self Employed | Card Against Card |

|---|---|---|

| Minimum Salary: INR 35,000 p.m. (Net Salary) | Minimum ITR: INR 6 lac annual ITR required | Minimum Competitor Credit Card limit: 1 Lac |

| Documents Required: Aadhar Card/Voter ID/Passport, Pan Card, Photo, Latest 2 month payslip & Latest 2 month bank statement. | Documents Required: Aadhar Card/Voter ID/Passport, Pan Card, Photo, Latest ITR Slip & 3 month bank statement. | Documents Required: Aadhar Card/Voter ID/Passport, Pan Card, Photo, Latest competitor Credit Card Statement (Card should be 6 month old) |

Conclusion

Great, You read all about HDFC Millennia Credit Card, but still you are in doubt, it is good for you or not. Then Don’t worry we summarise for you.

You can get this card lifetime free with some condition and also you can good credit limit in Millennia Credit card. In this credit card also in some condition 1 Reward Points : 1 Rupee. If you are a online shopper then this card is worthful for you because you get 5% cashback on online major brands. You get also free access at domestic airport lounge in the HDFC Millennia credit card also.

One also benefit if you take hdfc millennia credit card you are also eligible for pre-approved loan from HDFC Bank without any documents like in today days some loan apps are offering loan without any documents.

Now you can consider you want to member of HDFC Millennia Credit Card or not?